Picture this: Late, charts show on your laptop, and your pal texts, “Will Bitcoin ever hit $100K or is this just smoke and mirrors?” You smile, sip your drink, and think back on the rollercoaster last year. Everyone yearns get a glimpse of the future, particularly given the bitcoin price prediction dancing every week. Prediction is like meteorology: everyone tries, none of which guarantees success every time.

Analysts rush over indicators. Certain people take moving averages like gospel. Some follow whale wallet movements or discuss the halving cycle as though it were an old prophesy. Twitter bursts when Bitcoin so much wiggles upwards. One yells “To the moon!” and another yells “I’m all in stablecoins!” Not overlooked are macro events—regulation buzz, ETF introductions, and conflict news may pull prices faster than a cat following a laser pointer.

Technical review People fight about triangle, candles, and Fibonacci magic while drawing simple lines on charts. Ask three chart gurus for four different points of view. Seeing them disintegrate zones of support and resistance is like seeing a complex card trick—excellent until the wind blows.

Macroeconomic elements, meantime, hide behind the scenes. Numbers on inflation cause abrupt spikes. Central banks change interest rates, and suddenly Bitcoin is not only “digital gold”—sometimes it’s fool’s gold or the last golden ticket remaining. Then Elon Musk tweets a meme, and in ten minutes of frenzy the entire careful balance vanishes.

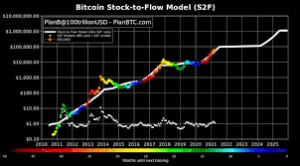

Always there is the “fundamental” crowd. They will cover layer-2 adoption, miner activity, or scarcity. It sounds reasonable, but then anarchy results from a hacker pulling currency from an exchange. You are discussing supply shock one minute, next your uncle is swearing off cryptocurrencies permanently.

People trade numbers like darts—$45K next month! By Christmas, $250K! Making comparisons between forecasts is a challenge in itself. While optimists passionately defend their spreadsheets and gut feelings, skeptics claim it is all hot air.

Not pretend anyone can call the top or bottom. Some astute traders do nail calls, usually by chance or perfect timing—stories you will hear at backyard get-togethers. Mostly, they chase pumps and keep an eye on dumps. Prediction sometimes is more heart palpitations and less math.

For those hair-tearing over the cost, there is a reality bomb: nobody knows exactly. Though Bitcoin does its own thing, you may create a model, read the news, gaze at the candles. Roll the dice, flip a coin, or simply enjoy the ride; this circus is not about to close anytime soon. And should it surpass $100K, you will at least have a great narrative to share at your next coffee shop conversation.